Charging Sales Tax

Taxation must be enabled in order to apply sales tax to package purchases and winning bids. To enable taxation go to Setup > Taxation and chek the box to Tax Packages. Choose the correct method to Ta…

Updated

by Jon Doehling

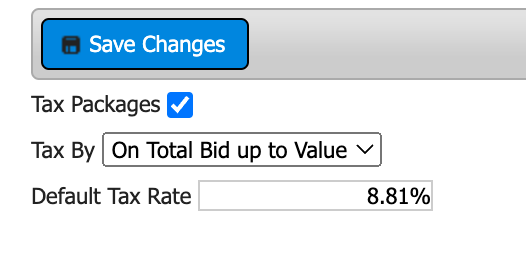

Taxation must be enabled in order to apply sales tax to package purchases and winning bids.

- To enable taxation go to Setup > Taxation and chek the box to Tax Packages

Choose the correct method to Tax By

- Total bid up to value

- On value

- On total bid

And set the Default Tax Rate

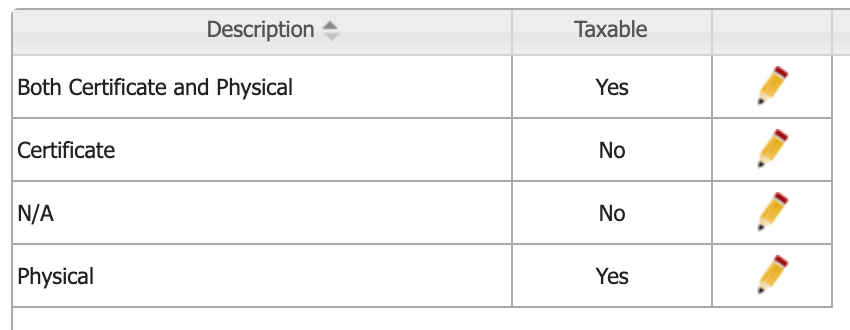

- Next, you will need to enable taxation for specific item types, under Setup > Item Pickup Types

Typically, sales tax is only applied to physical items, not certificates. However it is highly reccommended to consult with a tax advisor to determine the correct rates and applicable items for your state/municipality.

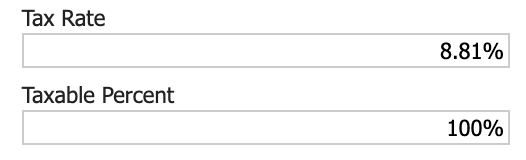

- When creating new items and packages, you will see fields where you may fill in the appropriate Taxable Percentage and Tax Rate. While the tax rate will usually stay the same for all items/packages in any given event, the taxable percentage will change based on the items included in the package.

For example:

- Item A is a Certificate and is valued at $100 (0% taxable)

- Item B is a Physical Item and is valued at $200 (100% taxable)

When Items A & B are combined into a package, that package will have combined value of $300 and is 66.67% taxable (200/300=0.6667).

If this package were to sell for $500 (greater than the item value) then based off of our intial setting of applying tax on total bid up to value (see step 1) we would see a tax amount of $17.62 for this package (300*0.6667*0.081).

How did we do?

App Settings

Details & Location